Financial Workshops

Benjamin Franklin believed in living within your mean. Well, what is my mean?

The Wealth Gap is Real

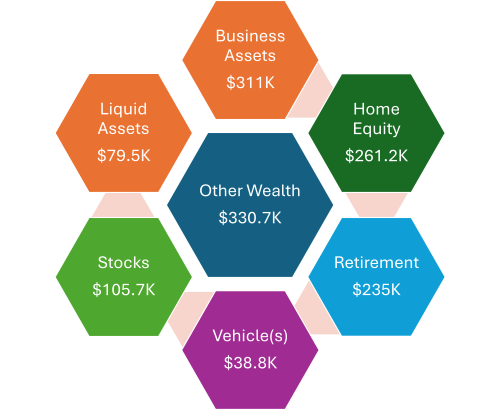

According to the National Community Reinvestment Coalition (NCRC) article published titled “The Racial Wealth Divide and Black Homeownership: New Data Show Small Gains, Deep Fragility” average net worth for White ($1.4 mil) compared to a typical Black ($211K) family in 2022.

These are facts:

| Median Wealth In 2022, the median wealth for Black households was $44,890, compared to $285,000 for white households, $62,000 for non-white Latino or Hispanic households, and $536,000 for Asian American households. | Wealth Distribution In 2021, only 45% of Black households were in the middle or upper wealth tiers, while 55% were in the lower wealth tier. |

| Homeownership In 2021, the homeownership rate for Black Americans was 44%, but the financial advantages of rising property values only benefitted a small fraction of Black families. | Consumer Debt Black households rely heavily on consumer debt, such as car loans, credit cards, and student loans, to cover expenses. This debt is often more costly and risky than the debt held by white households. |

< — White wealth wheel compared to the

Black wealth wheel —->

Black Wealth Over Time

The racial wealth gap has evolved over time, with some periods of convergence and other periods of stagnation. The civil rights movement led to the fastest period of racial wealth convergence sine 1900, but convergence stopped between 1980 and 2020.

Black Wealth Increased Under President Biden

Black Households made substantial gains in net worth between 2019 and 2022 Over this period, median Black net worth increased by 60% to $44,900, the largest increase of any racial group. This huge jump in wealth can be attributed mainly to housing which accounted for 43.8% of total Black wealth.

MONEY CONCEPTS EXPLORED

Investment, know how, financial planning, basic money management

- Understanding Money

- Understanding yourself, your rights, and responsibilities

- Managing everyday money

- Planning ahead

- Selecting financial products suitable for you

INTEREST CONCEPTS TO KNOW

Typical Compound Interest case studies are below:

Compound interest concepts refers to the concept that your money grows exponentially over time.

| Jeremiah wants to put away $20,000 into a 401K that pays 8% interest monthly for 40 years. How much do you think Jeremiah will have in his account at the 40-year mark? | Bettie wants to have at least $2,000,000.00 by the time she retires in 45 years. She opened an account that pays 9.5% quarterly. Betty wants to know how much she needs to invest today to reach the goal. |

| Compound Interest Formula: A=P(1+r/n) n*t A=amount we want to find. P=principle, the initial investment ($20,000) r=interest rate (8% or .08) n=number of annual payments (12) t=time or term (40 years) | Compound Interest Formula: A=P(1+r/n) n*t A=$2,000,000.00. P=principle unknown?? r=interest rate (9.5% or .095) n=number of quarterly payments (4) t=time or term (45 years) |

| Results: A = $485,467.79 is in Jeremiah’s account after 40 years of savings. | Results: P = $29,249.96 is starting principle needed for Betty to reach her goal of $2,000,000.00 of retirement funds after 45 years. |

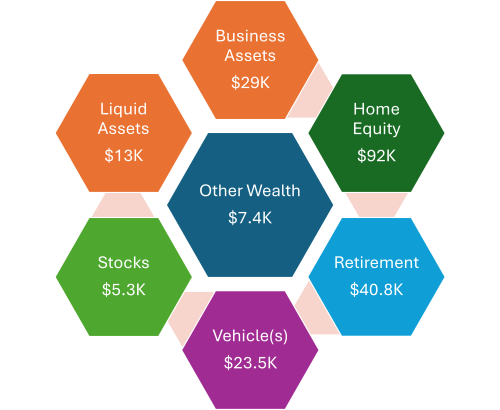

How my FICO score is created:

Fact: FICO credit scores are used by creditors to determine your credit worthiness. Basically, are you able to pay back the money your borrowed on credit.

Five factors of credit score:

- Payment history length

- Amount currently owed on credit

- History of payment time

- Any new credit opened

- Type of outstanding credit

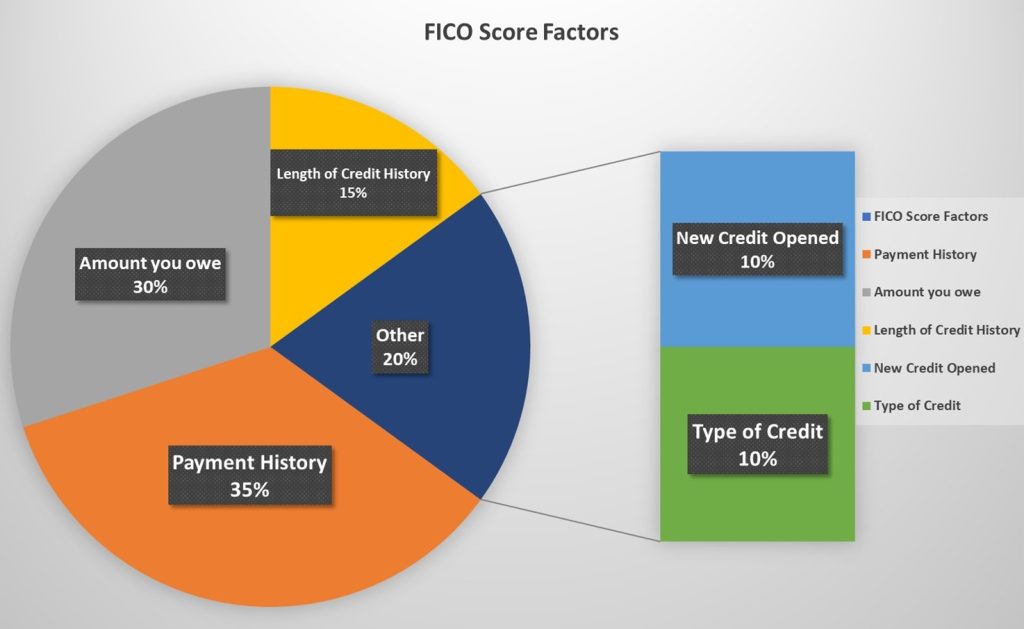

- Specific: goal easy to understand; Does it answer: Who – What – When – Where – How

- Measurable: Can I set milestones; How do I measure progress

- Achievable: Is this something reachable; Do I have the tools, dedication to follow a plan.

- Realistic: Is it within the realm of reality it can happen.

- Time-bound: Can I put a time range to achieve this financial goal.